Local Government Key Facts and Figures

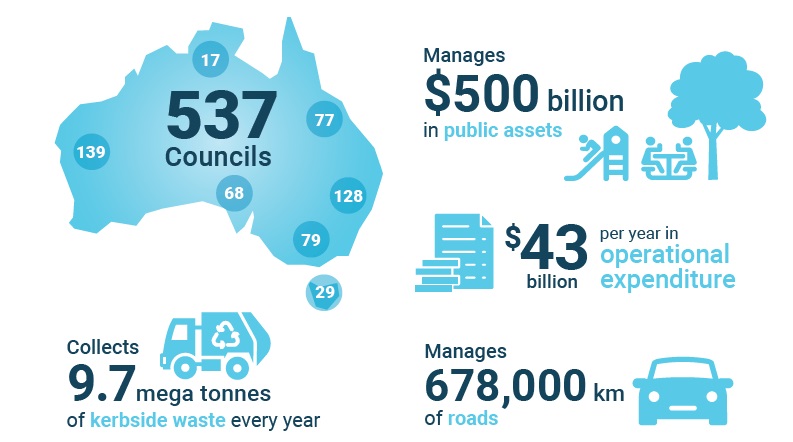

There are 537 councils Australia-wide. Around 55 per cent are located in regional, rural, or remote councils, about 25 per cent urban and urban fringe and 20 per cent urban region.

Local government employs 190,800 people, across more than 400 occupations, which is nearly 10 per cent of the total public sector as 30 June 2021. [Local Government Workforce Skills and Capability Survey 2022].

There are around 5670 elected councillors in Australia, according to state and territory electoral commission and industry data.

The gender breakdown of the Australian local government workforce is 50.9 per cent male and 49.1 per cent female.

Local government revenue from rates in 2020-21 was about $20 billion [ABS Government Finance Statistics, Australia, 2020-21]. In 2018-19, local government collected $19 billion in rates.

Local government’s total annual expenditure in 2020-21 was approximately $43.1 billion, representing a 10.72 per cent increase since 2018-19. [Local Government Workforce Skills and Capability Survey 2022].

Local government non-financial assets including roads, community infrastructure such as buildings, facilities, airports, water, and sewerage (in some states) including land, are valued at $500.8 billion [ABS Government Finance Statistics, Australia, 2020-21].

Federal Financial Assistance Grants to councils have slipped from one percent of Commonwealth taxation revenue in 1996 to just 0.52 percent today.

States and territory net tax revenues rose an average of 8.8 percent to $92 billion [ABS Taxation Revenue 2020-21]. However, by contrast, local government increased tax revenue by only 2.6 per cent to $20 billion.

General facts about local government

The first local government established in Australia was in Adelaide in 1840.

Australia’s largest council by population is Brisbane City Council, servicing a population of 1.25 million.

Australia’s largest council by area is East Pilbara in Western Australia. It covers an area of 379,571 square km (larger than Victoria), has a population of 11,005 and 3,237km of roads.

At 1.4 square kilometres, and with 1524 residents, the smallest local government area is the Shire of Peppermint Grove Council, Western Australia.

Australia has had four Prime Ministers who served on local councils.

- John Gorton (Kerang Shire Council)

- Ben Chifley (Abercrombie Shire Council)

- Earle Page (South Grafton Council)

- Arthur Fadden (Townsville City Council).

Infrastructure and assets

Local roads make up around 75 percent of the national road network (by length) and service every Australian and business on a daily basis. About 657,000km of the nation’s roads are managed by local governments.

In 2020-21, local government non-financial assets including roads, community infrastructure such as buildings, facilities, airports, water, and sewerage (in some states) including land, was valued at $500.8 billion [ABS Government Finance Statistics, Australia, 2020-21].

ALGA’s 2021 State of the Assets report showed two-thirds of all local government assets are in good condition while around one-third are not. Specifically, nearly 1 in 10 of all local government assets need significant attention, and 3 in every 100 assets may need to be replaced.

The Australian Bureau of Statistics [Government Finance Statistics released 26 April 2022] says the three highest levels of local government expenditure in 2020-21 were:

- $9.58 billion on General Public Services

- $10.30 billion on Transport and Communications

- $6.85 billion on Recreation, Culture and Religion. (This figure includes expenditure of Roads to Recovery funding of $591.6 million in 2020-21 Budget).

Jobs and skills

More than nine out of every 10 councils in Australia are facing jobs and skills shortages which are acting as a handbrake on local productivity. [Local Government Workforce Skills and Capability Survey 2022].

The professions most in demand include engineers, town planners, building surveyors, environmental health officers, accountants and HR professionals.

The main issues councils are experiencing are a shortage of skilled candidates, and often an inability to compete with the private sector and other levels of government on remuneration.

Natural disasters and recovery

2022 was a challenging year for Australian councils and our communities, with more than 500 disaster support declarations across 316 local government areas.

Roles and responsibilities

Constitutional responsibility for local government lies with state and territory governments. Consequently, the roles and responsibilities of local government differ from state to state.

Local government services cover all areas and can include:

- Infrastructure and property services, including local roads, bridges, footpaths, drainage, waste collection and management;

- Provision of recreation facilities, such as parks, sports fields and stadiums, golf courses, swimming pools, sport centres, halls, camping grounds and caravan parks;

- Health services such as water and food inspection, immunisation services, toilet facilities, noise control and meat inspection and animal control;

- Community services, such as childcare, aged care and accommodation, community care and welfare services;

- Building services, including inspections, licensing, certification, and enforcement;

- Planning and development approval;

- Provision of and management of facilities, such as airports and aerodromes, ports and marinas, cemeteries, parking stations and on-street parking;

- Cultural facilities and services, such as libraries, art galleries and museums, and community events;

- Water and sewerage services; and

- Other services, such as abattoirs, saleyards and group purchasing schemes.

Download Facts and Figures infographic.

(Last updated March 2023)